10 Key Takeaways From NetApp CEO George Kurian: Cloud, Coronavirus And Growth

“[Businesses] are now looking to accelerate digital transformation to drive competitive advantage by delivering services and products remotely, reaching customers through digital means, and optimizing remote operations and collaboration,” says NetApp CEO George Kurian.

NetApp Building Its Cloud Business, Thriving Despite COVID-19

NetApp on Wednesday reported a very surprisingly successful first fiscal quarter 2021. And it was a surprise, both because NetApp‘s last few fiscal quarters have suffered from falling sales and because the IT industry along with the rest of the economy has taken a big hit from the COVID-19 coronavirus pandemic.

However, NetApp saw total revenue for its first fiscal 2021 quarter rise 5 percent to $1.3 billion, revenue for its all-flash array business increase 34 percent on an annual net revenue basis, and annual recurring revenue grow 192 percent.

NetApp CEO George Kurian used his prepared remarks and analyst questions during the company‘s quarterly financial conference call to talk about the growth of its cloud and all-flash storage business, its competitive environment including a look at Dell’s new PowerStore, the impact of the pandemic, and more as a way to provide insight into both what happened during the quarter and what to expect going forward.

“With the ongoing pandemic, the near future remains uncertain for many companies, and no one knows when we will return to a more normal and predictable environment,” he said. ”Despite the uncertainties, one thing is clear: Data is growing in scale and importance. We help the world‘s leading organizations solve the challenge of managing their most critical data.”

For a look at what is impacting NetApp and the IT industry, turn the page.

Adjusting To The ‘New Normal’

In response to the new normal caused by the COVID-19 pandemic, the majority of NetApp employees are working from home, Kurian said. The company‘s sales team is meeting remotely with customers and building demand, he said. NetApp has also moved its Executive Briefing Center to a virtual format, and saw a 50-plus-percent increase in visits during the first quarter compared to a year ago. NetApp also saw a doubling in the number of prospects in its virtual executive briefing centers compared to input and meetings last year, he said.

NetApp has already told its employees to expect to be working from home until July of next calendar year, Kurian said.

“We continue to deliver heightened support for customers delivering vital public health and safety services, first responders, and public sector institutions. For IT teams affected by the pandemic, we are offering 25 terabytes of NetApp‘s Cloud Volumes Service for Google Cloud free of charge. We also extended our partner financing program to assist partners and customers in managing their cash flow.”

Customers Driving Digital Transformation In Response To Pandemic

While the initial response to COVID-19 was to quickly shift resources to help businesses‘ employees work from home, that is now shifting towards an acceleration of digital transformation, Kurian said.

“[Businesses] are now looking to accelerate digital transformation to drive competitive advantage by delivering services and products remotely, reaching customers through digital means, and optimizing remote operations and collaboration,” he said. ”The acceleration of digital transformation means more enterprises are managing IT environments both on-premises and in the cloud.”

NetApp leverages its rich data-centric software innovation to help businesses expand in this hybrid cloud world and helps move their applications to the cloud significantly faster than any other vendor, Kurian said.

“Rapidly deployed business continuity solutions enable remote work forces to collaborate and accelerate application software development,” he said. ”We bring enterprise-grade data services to the cloud and the simplicity and the flexibility of the cloud to the enterprise data center. With our Data Fabric strategy, we help customers tackle the challenges of hybrid cloud. No matter where a customer is on their hybrid cloud journey, NetApp can help them achieve their goals.”

All-flash Storage Array Sales Up

NetApp in its first fiscal quarter saw a 34-percent year-over-year growth in its all-flash business, and the company expects it has gained share in this important market, Kurian said.

“During these uncertain economic times, customers are finding even greater value in our ability to help them take advantage of high-performance all-flash arrays while reducing total cost of ownership through automated tiering to a lower-cost cloud or object tier,” he said. ”This and other industry-leading capabilities helps drive strong growth for both StorageGRID and the NetApp A-series all-flash FAS arrays.”

Competition With Dell PowerStore

When asked by a financial analyst about the competitive environment particularly with the introduction of Dell‘s new PowerStore line, Kurian said NetApp’s all-flash array business was powered by its differentiation in flash storage, object storage as an archrival tier, and hybrid cloud.

During the first fiscal quarter, NetApp took several data center environments in large customers away from competitors like Hitachi Vantara and Dell, Kurian said.

“The [Dell] PowerStore product that [Dell] has brought to market is not being well received by customers, and we are displacing them several accounts,” he said.

Progress In The Cloud Business

As businesses begin to deploy critical workloads in the cloud and increase the need for enterprise-grade capabilities, NetApp is seeing its cloud business grow quickly, Kurian said.

“Leading with cloud in the marketplace enables us to reach both installed base customers and new to NetApp customers,” he said. ”In Q1, roughly half of the new-to-NetApp customers came into our cloud business. New customers, growth at existing customers, and an expanded portfolio drove an acceleration of our cloud ARR (annual recurring revenue) to $178 million, an increase of 192 percent year over year.”

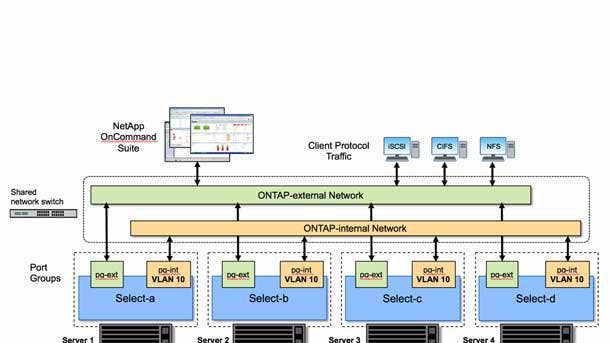

Key to the company‘s success in the cloud and on-premises is NetApp’s Ontap storage operating system software, which Kurian called the market’s most powerful, most cloud-connected, and most efficient storage operating system.

“We provide customers with a consistent operating system across data center and cloud to unify their hybrid cloud [and] the flexibility of a cloud-like purchasing experience through our Keystone Service,” he said. ”One of the key features of Ontap is Fabric Pool, which allows customers to create policies for the automatic tiering of infrequently accessed data to a more cost-effective tier, such as Azure, AWS, Google, or any S3 target.”

Keystone Off To A Good Start

NetApp Keystone, which was introduced in October, is aimed at letting businesses purchase their on-premises and cloud-based storage capabilities without worrying about future requirements by allowing data to be migrated as needed across on-premises, private clouds or public clouds, and either purchased outright or on a consumption model.

When asked by an analyst about how NetApp Keystone is doing, Kurian said the technology is off to a good start and is now selectively available to customers in some of geographies.

“We‘ve had several competitive wins this quarter with Keystone,” he said. ”[Keystone] is a good complement to our public cloud services. So a customer that has a temporary workload or wants to move an entire business process to the public cloud can choose the public cloud, and if there’s a portion of that business process or there’s a complementary infrastructure that they want to have deployed and run within their data center for compliance reasons or for integration with other applications, they can use Keystone and get a single experience from their data center to the public cloud.”

Accelerating Investments In The Cloud

Kurian said that during its first fiscal quarter 2021, NetApp made two important cloud acquisitions: CloudJumper, a provider of cloud-based virtual desktop services, and Spot, a leader in compute management and cost optimization on public clouds.

“These acquisitions bring strong talent with cloud DNA to our marketing, sales, and engineering teams,” he said. ”And they are driving increased interest in NetApp. More customers are coming to us because they are excited by our cloud strategy and ability to help them deploy applications and optimized compute and storage in the cloud.”

When an analyst asked for details about Spot, Kurian said it identifies the pattern of behavior of both traditional and cloud applications and finds the optimized compute environment to run those applications most cost effectively.

“[Spot] is optimizing the run-time environment for customers, regardless of what version of Kubernetes they use, which cloud provider they run on, and whether they‘re using a traditional applications or a cloud-native application,” he said. ”[And] now because we can optimize compute and storage, we are able to address 70 percent of a typical customer’s cloud bill and optimize a substantial amount of that cloud bill.”

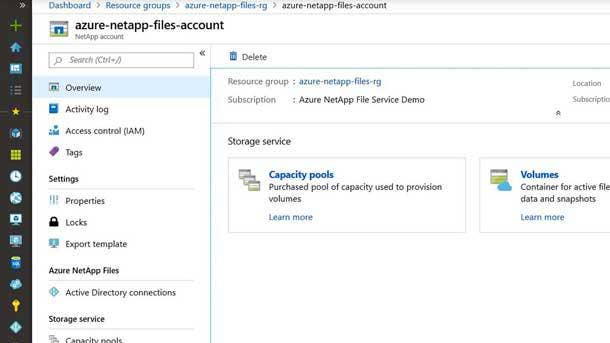

Azure NetApp Files

When an analyst asked about the progress NetApp is having with its Azure NetApp Files, which is Microsoft Azure‘s first service for migrating and running enterprise file-based workloads and based on NetApp’s Ontap storage operating system, Kurian said that business is off to a very good start.

NetApp has had a long-term focus on customers‘ most important workloads to the cloud, Kurian said.

“These workloads are incredibly sticky once they‘re deployed in the cloud,” he said. ”But they require planning and deliberation before you do that. What we saw through the course of the quarter was sequential acceleration of our cloud storage business where not only did our business with Microsoft grow, but our business with the other hyperscalers was also off to a really good start. We are seeing the software-based solutions which complement the high-performance Azure NetApp Files use cases growing nicely. And our acquisitions are allowing us access to net-new customers and new wallets, the compute wallet and the desktop-as-a-service wallet. So I couldn’t be more pleased about the progress.

NetApp Layoffs And Its SolidFire And HCI Impact

Kurian, replying to an analyst‘s question, confirmed reports that NetApp has realigned 5.5 percent of the company‘s workforce, particularly in those parts of the business not aligned with NetApp’s go-forward priorities.

“You know, these headcount reductions are never easy to make,” he said. ”And we take care and consideration when we decide to make those changes. Those changes were driven by the strategic alignment and focus that we have to prioritize our resources in the core storage systems and software business, as well as accelerating our public cloud services business.”

Kurian also confirmed changes to its SolidFire business and its HCI hyper-converged infrastructure offering built on SolidFire.

“SolidFire, yes, I can confirm was part of the team that was impacted,” he said. ”We are narrowing our focus with the SolidFire and HCI portfolio to the high-margin parts of the market as we have signaled on prior calls.”

NetApp's Merger And Acquisition Strategy

When asked by an analyst about the company‘s merger and acquisition strategy, Kurian said NetApp is a disciplined acquirer for strategic, cultural, and economic fits.

“We‘ve been clear that we have a broad range of interests, but software and cloud-centric would be the two key filters that we would look at in terms of transactions,” he said. ”As we’ve also said, we are skeptical about doing big, large transactions. I think those are far and few between. And so the majority of our investigations are more smaller transactions.”